XRP is seeing big gains over the past few days, developed by the digital payment network Ripple. It’s currently valued at around $11 billion and is trying to go mainstream by launching its own ETF. However, it’s currently entangled in a long-standing case with the SEC, which seems to be blocking the launch.

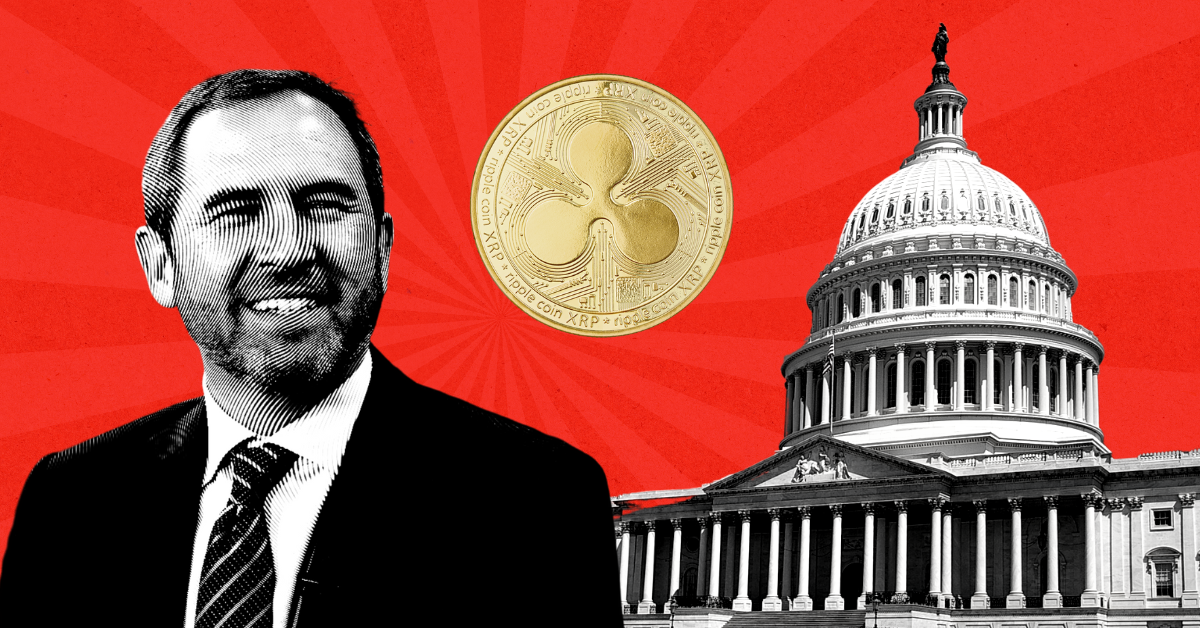

Ripple CEO, in the latest interview on BBC, has explained his crypto checklist sent to Trump for his first 100 days.

“A War Against Crypto”

When asked what are the main things he wants Trump to address, he noted that Trump has been self-proclaiming himself as a crypto President and has been a crypto advocate recently. He also highlighted that one of the first things Trump promised to do on the first day of his office was to fire Gary Gensler, who, Brad believes, “has really waged a war against crypto in the United States.”

He emphasized that countries like the UK, Singapore, and Switzerland have ‘leaned into crypto’ and have created clearer rules, which has allowed the entrepreneurs and the capital to flow, which is helping the industry to grow and thrive.

XRP Not A Security- The Law Of the Land

Brad disclosed that they have been fighting with the SEC for three and a half years and that they won that case last summer. The judge in that case declared very explicitly that XRP in and of itself is not a security. The SEC is appealing part of that decision, but importantly, he noted that they’re not appealing the part of the decision that says XRP is not a security.

He noted that they feel very good about this as the law of the land of the United States is that XRP is not a security.

But what’s frustrating for the whole industry according to Brad is that only Bitcoin and XRP have the explicit regulatory clarity in the United States. Other leading cryptocurrencies like ETH and Solana have been facing troubles.

He termed it as ‘maddening’ to litigate every single token one by one. He emphasized that people in the US crypto industry want to follow the rules and they have been challenging the SEC to create clear rules of the road. He highlighted the UK and Japan’s taxonomies created so that the regulation is clear.

What is The Key Change Brad Expects?

Finally, he noted that the key thing is the SEC under Gensler has tried to take the position that most cryptocurrencies are securities.

He explained that Securities are about rights and ownership of a company. He gave an example that if you own a security in Apple, you own part of the company, which is not the case with crypto. Therefore, he stated that the key is creating that clarity that the SEC is not the regulator “that is trying to kind of own this industry”.

He also noted that the agency has been trying to do regulation through enforcement rather than codifying and taking the time to write clear rules of the road.

Earn more CFN tokens by sharing this post. Copy and paste the URL below and share to friends, when they click and visit Parrot Coin website you earn: https://cryptoforum.news0

CFN Comment Policy

Your comments MUST BE constructive with vivid and clear suggestion relating to the post.

Your comments MUST NOT be less than 5 words.

Do NOT in any way copy/duplicate or transmit another members comment and paste to earn. Members who indulge themselves copying and duplicating comments, their earnings would be wiped out totally as a warning and Account deactivated if the user continue the act.

Parrot Coin does not pay for exclamatory comments Such as hahaha, nice one, wow, congrats, lmao, lol, etc are strictly forbidden and disallowed. Kindly adhere to this rule.

Constructive REPLY to comments is allowed